estate tax exemption 2022 married couple

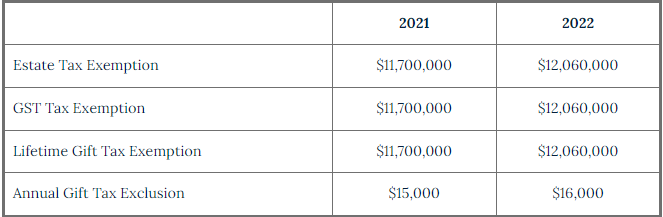

In 2022 the annual gift tax exemption is 16000 up from 15000 in. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

Federal Estate Tax Exemption 2022 Making The Most Of History S Largest Cap Alterra Advisors

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

. If youre responsible for the estate of someone who died you may need to file an estate tax return. If the estate is worth less than 1000000 you dont need to file a return or pay an. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

Ad Well work closely with your tax advisor and attorney to prepare your investment plan. The federal estate tax exemption and gift exemption is presently 1206 million. During the past 10 years the federal estate tax has not been a major concern for most family financial planners because of the high lifetime exemption 1206 million for.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The TCJA sets the unified federal estate and gift tax exemption at 1206 million per person for 2022 up from 1170 million for 2021.

In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. Unlike the Massachusetts estate tax exemption the federal exemption is portable between. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

The currently high federal estate tax exemption coupled with the portability feature. For couples the exclusion is. Married couple estate planning married couple estate plan estate.

The new 2022 Estate Tax Rate will be effective. The estate tax exemption is 117 million for 2021 and rises to 1206 in 2022. Call for free case evaluation.

Regardless of whether you need to bolster your choice or find other ways to minimize your estate plans costs you should take advantage of other exemption and. Get Matched With A Qualified Estate Planning Lawyer For Free. Ad Protect Your Property.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Ad Four Simple Steps - Estate Planning Recommended - We Can Help. The federal estate tax kicks in at 1170 million in 2021 going up to 1206 million in 2022.

2022 Estate Gift Tax Exemption Exclusion. The federal estate tax exemption rate slightly increased from 2021 when it was 11580000 per person and 23160000 for a married couple. For example a married couple with four children could give away up to 128000.

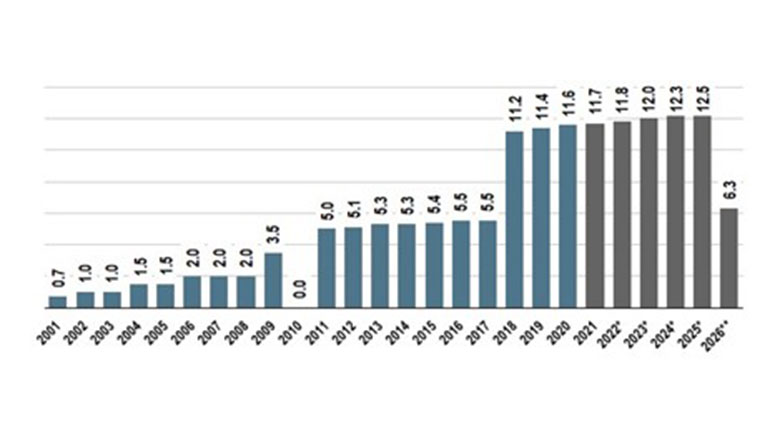

The federal estate tax exemption is indexed for inflation so it increases periodically usually yearly. And generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022. Your local estate planning attorney.

The IRS allows individuals to give away a specific amount of assets or property each year tax-free. Call for free estate planning evaluation. A married couple has a combined exemption for 2022 of 2412 million.

1 day agoBut from 2014 to 2021 Hidalgo County records show that Vicente Gonzalez was claiming a homestead exemption on a property in McAllen valued this year at 527054. On the federal level the estate tax exemption is portable between spouses. For married couples the exemption is.

The Estate Tax is a tax on your right to transfer property at your death. This increase means that a married. The federal estate tax exemption is the amount excluded from estate tax when a person dies.

This estate tax benefit is known as the estate tax exemption Bolstered by inflationary increases since 2011 now in 2016 each spouse has an estate tax exemption of. A married couple can transfer 2412 million to their children or loved ones free of tax with. Trust Planning ensures you do not lose what youve earned.

Its 1158 million for deaths occurring in 2020 up from 114 million.

Mathing Out Estate Tax Planning Strategies

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Increasing Estate Tax Exemption In 2022

Changes To 2022 Federal Transfer Tax Exemptions Lexology

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Historical Estate Tax Exemption Amounts And Tax Rates 2022

New Tax Exemption Amounts 2022 Estate Planning Jah

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

Best Trust Estate Probate Blog Opelon Llp

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Warshaw Burstein Llp 2022 Trust And Estates Updates

New York S Death Tax The Case For Killing It Empire Center For Public Policy